Investing in gold has long been considered a safe haven during economic uncertainty. As inflation rises and stock markets fluctuate, many investors are looking for ways to diversify their portfolios, and gold is often a top choice. One option that some individuals may not be aware of is the possibility of buying gold with funds from their 401(k) retirement accounts. This report will explore how to invest in gold using a 401(k), the benefits and drawbacks of such an investment, and the steps involved in the process.

Understanding 401(k) Accounts

A 401(k) is a tax-advantaged retirement savings plan offered by employers that allows employees to save and invest a portion of their paycheck before taxes are taken out. Contributions to a 401(k) can reduce an individual’s taxable income, and many employers offer matching contributions, which can significantly enhance retirement security with gold iras savings over time. However, traditional 401(k) plans typically limit investment options to stocks, bonds, and mutual funds.

The Case for Gold Investment

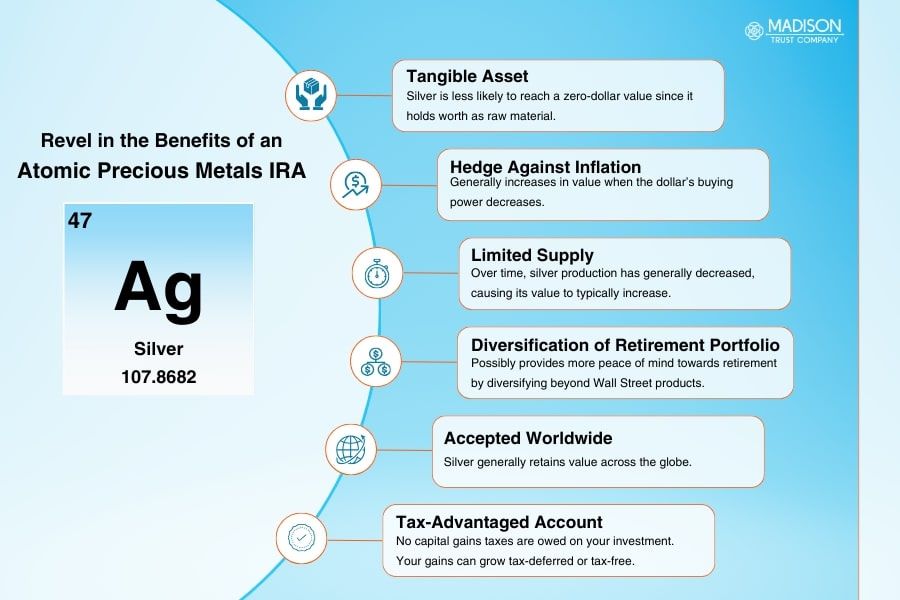

Gold is often seen as a hedge against inflation and currency devaluation. When economic conditions are unstable, gold tends to retain its value better than other assets. Additionally, gold is a tangible asset that can provide a sense of security. For these reasons, many investors consider adding gold to their portfolios, including those using 401(k) funds.

Can You Buy Gold with a 401(k)?

The short answer is yes, but with some caveats. Direct investments in physical gold are generally not allowed within a traditional 401(k) plan. However, there are ways to gain exposure to gold through your 401(k):

- Gold ETFs and Mutual Funds: Many 401(k) plans offer investment options that include gold exchange-traded funds (ETFs) or mutual funds that focus on gold mining companies. These funds invest in gold-related assets, allowing investors to gain exposure to gold without owning the physical metal.

- Self-Directed 401(k): Some employers offer a self-directed 401(k) option, which allows for a broader range of investment choices, including the ability to invest in physical gold. This option is more flexible but requires more knowledge and management from the investor.

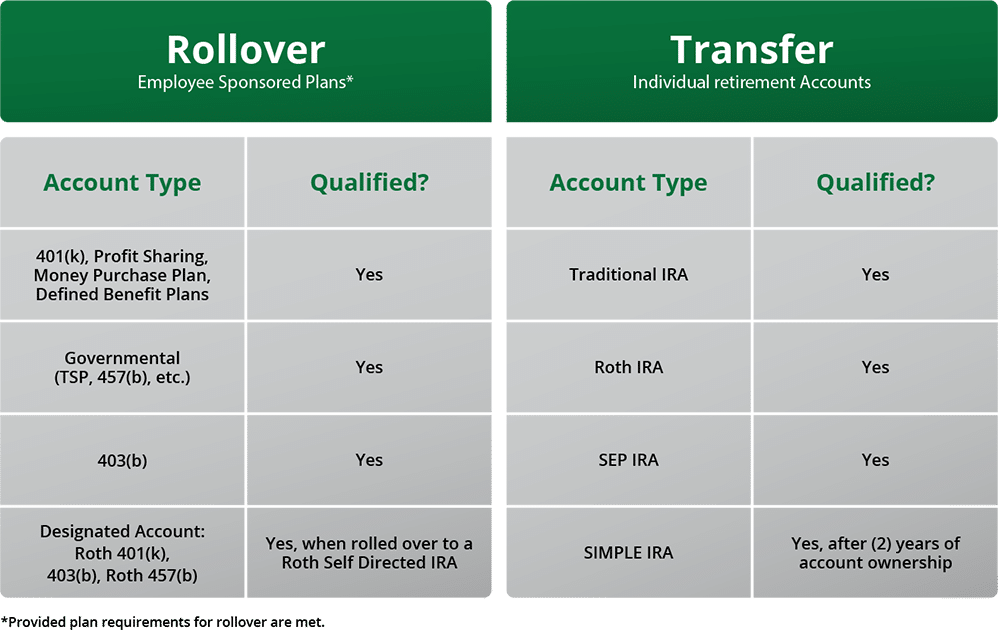

- Rollovers to Gold IRAs: If you are looking to invest in physical gold, you can roll over your 401(k) into a Gold Individual Retirement Account (IRA). This process involves transferring your retirement funds into a specialized IRA that allows for the purchase of physical gold and other precious metals.

Steps to Buy Gold with Your 401(k)

- Review Your 401(k) Plan: Before making any decisions, review your current 401(k) plan to understand the available investment options. Check if your plan offers gold ETFs or mutual funds.

- Consult with a Financial Advisor: It is advisable to speak with a financial advisor who can help you understand the implications of investing in gold and how it fits into your overall retirement strategy.

- Consider a Self-Directed 401(k): If your employer offers a self-directed option, you may want to consider this route. Research providers that offer self-directed 401(k) accounts and understand the associated fees and affordable investment in gold-backed iras options.

- Explore Gold IRA Rollovers: If you decide that investing in physical gold is the best option for you, research reputable Gold IRA custodians. Ensure that they are IRS-approved and have a good track record. You will need to fill out the necessary paperwork to initiate the rollover process.

- Choose Your Gold Investments: Once your Gold IRA is set up, you can purchase physical gold. This can include gold bullion, coins, or bars. Be sure to understand the storage and insurance requirements for holding physical gold.

Benefits of Investing in Gold with a 401(k)

- Diversification: Gold can provide diversification to a retirement portfolio, reducing overall risk.

- Inflation Hedge: Gold often retains its value during inflationary periods, protecting purchasing power.

- Tangible Asset: Owning physical gold can provide a sense of security, especially during economic downturns.

Drawbacks of Investing in Gold with a 401(k)

- Limited Options: Not all 401(k) plans allow for gold investments, which may limit options for some investors.

- Fees: Investing in gold, especially through ETFs or mutual funds, can involve management fees that may reduce overall returns.

- Market Volatility: While gold is often viewed as a safe haven, its price can still be volatile, and significant price fluctuations can occur.

Conclusion

Investing in gold with a 401(k) can be a viable strategy for those looking to diversify their retirement portfolios and protect against economic uncertainty. In case you loved this article and you would love to receive more info regarding castlesclick.com kindly visit our web page. While direct investments in physical gold may not be possible within a traditional 401(k), options such as gold ETFs, mutual funds, and Gold recommended gold-backed iras for retirement provide pathways to include gold in retirement savings. As with any investment, it is essential to conduct thorough research and consult with a financial advisor to ensure that such investments align with your long-term financial goals. By understanding the intricacies of your 401(k) plan and the various avenues available for gold investment, you can make informed decisions that support a secure financial future.